From Bretton Woods to Afghanistan

You can subscribe to receive these notes by email here

The chaotic scenes from Kabul over the past fortnight have shocked, with Thursday’s attacks at the airport creating even more tragedy.

The strategic decision to fully withdraw from Afghanistan can be argued (although the US domestic political case for withdrawal is clear). But the withdrawal itself has been a messy, heartbreaking process.

I don’t think that this experience will materially alter the credibility of the US commitment to other geographies such as Taiwan and Israel. Or that it will do much to weaken the US in terms of strategic competition with China: the US won the Cold War after the withdrawal from Saigon in 1975.

America First

But the manner in which the withdrawal was approached sends a message about US engagement with the world. In particular, there was little meaningful prior coordination by the US with NATO allies and others on the withdrawal of military and diplomatic personnel - as well as other at-risk people. And the G7 discussions on Tuesday, convened by Boris Johnson, yielded little.

Allies who have committed substantial personnel and resourcing to Afghanistan since 2001 have had to scramble. Much frustration has been expressed. The emotional debate in the UK House of Commons last week showed the depth of feeling.

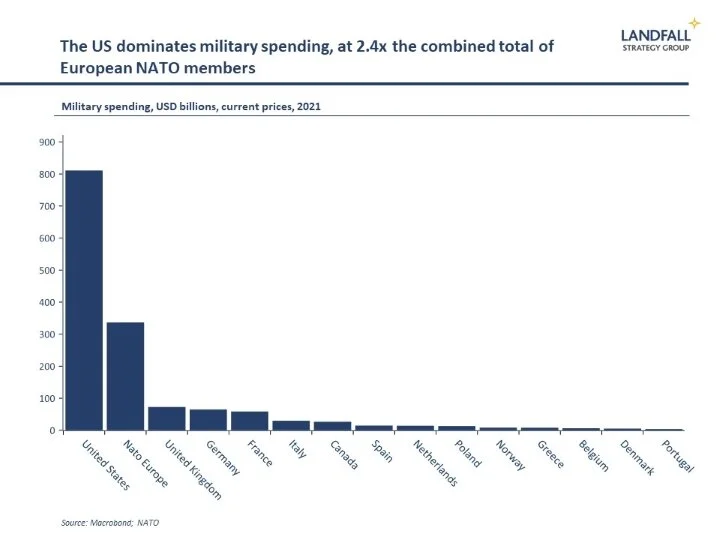

The US has repair work to do on these relationships. But for all of the protests of European countries, they remain reliant on US hard power: US military spending is 2.4x that of all European NATO members combined. Realpolitik will constrain the extent of rupture..

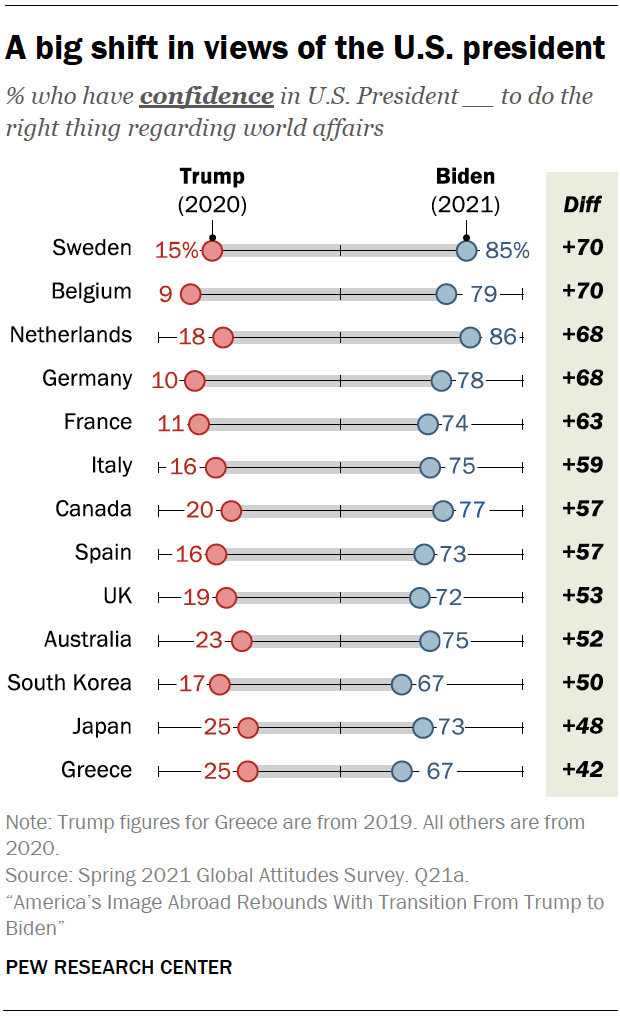

This was an example of America First in action. Mr Trump expressed this America First agenda crudely and pursued it ineptly. But – despite the international opinion polls – the broad foreign policy approach is not so different under Mr Biden, although more competent and less abrasive.

Of course, the tone is very different. Mr Biden has made several well-received statements at the recent G7 and elsewhere on the importance of cooperation among like-minded countries on strategic issues from climate change to China. But recent US actions speak louder than words.

Nothing new under the sun

This US behaviour ought not come as a surprise. History shows that big powers tend to act like big powers. Beyond the near-term policy continuity over the past year, there has been a broad continuity in US decision-making over the past several decades.

Indeed, it is striking that almost 50 years ago to the day, there were also secret discussions at Camp David, blindsided US allies, and unilateral US decisions on issues of strategic importance.

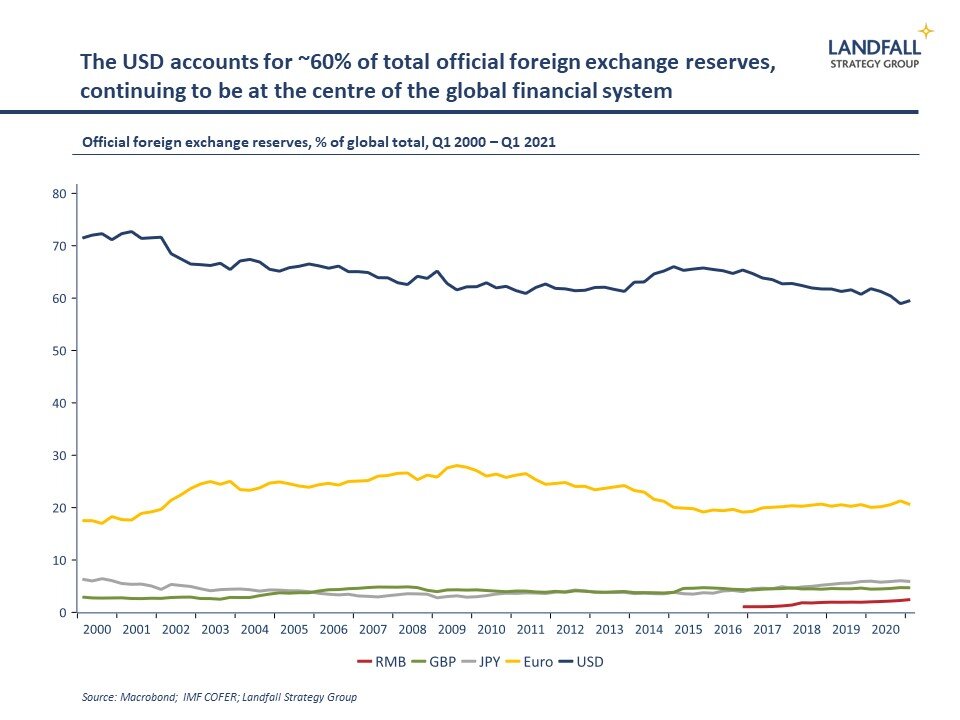

In August 1971, the Nixon Administration finalised secret policy debates on exchange rate arrangements. It announced that it was immediately suspending gold convertibility of the USD, and imposed a 10% tariff to give itself negotiating power over exchange rate realignment – de facto ending the Bretton Woods system of fixed exchange rates. A recent book by Jeffrey Garten on this episode was good summer reading.

There was no attempt to coordinate with partners in Europe and Japan, even though it led to tectonic changes in the international economic and financial system. Many only found out as the President went on live TV to announce the decision. As combative Treasury Secretary John Connally subsequently said, ‘the dollar is our currency, but your problem’.

So a line can be drawn from the Presidential deliberations at Camp David in August 1971 to those in August 2021. The economic and military centrality of the US gives it an exorbitant privilege in prioritising its domestic interests.

This state of affairs has been accepted because the US continues to underwrite the global system – and because there are no good alternatives. This remains broadly true.

Looking ahead

Analysis of the implications of the Afghanistan withdrawal has focused on the impact on the region as well as on the competition between the US and China. But the key takeaway for me is the revealed preference in the US for a narrower focus on its core national interests – even when this comes at a reputational cost.

Indeed, the US has also been unwilling to export significant numbers of Covid vaccines (relative to the EU); and recently called on OPEC to produce more to reduce upward pressure on oil prices – not entirely consistent with US commitment to addressing climate change. Looking forward, the Biden Administration’s focus on a ‘foreign policy for the middle class’ likely means a more inwardly-focused agenda on trade.

US leadership remains critical to progress on many global issues, including through multilateral approaches. But we are also likely to see more coalitions of the willing, such as the Quad in Asia, in response to a more focused US.

And there is space for middle powers to become more relevant in terms of hard power projection as well as economic diplomacy – although significant investment and capability building will be required. Global Britain needs to become more than a slogan.

Smaller economies were able to navigate through the Trump years relatively well, avoiding the tariffs and tweets. But, although the melodrama has gone, the Biden Administration is likely to represent a more challenging strategic environment – in that it will require countries to make hard choices and step up their investments.

The Afghanistan withdrawal is well down the list of issues that markets are concerned about; indeed, equity markets have been hitting new records over the past couple of weeks. But the potential for broader tensions between Western powers, and the challenges to coordinated policy action, could cause turbulence over a longer time horizon.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors. Do let me know if your organisation is interested in arranging a discussion.

Chart of the week

The return of air travel has stalled after a strong recovery over the past several months, and remains well down on 2019 levels. US air travel growth has softened due to the spread of delta, and strong domestic travel within China has reversed because of domestic lockdowns. Europe has performed well over the summer, supported by the vaccination passport. In general, domestic travel and intra-EU travel is much stronger than long-haul travel – because of border restrictions as well as consumer risk aversion and uncertainty. This profile will likely remain.

Other writing

I had a paper published by the Institute for Emerging Market Studies at the Hong Kong University of Science & Technology on the challenges and opportunities for Hong Kong from the Greater Bay Area initiative – drawing on the experience of regional integration in other small advanced economies. The paper is available here.

Around the world in small economies

Small economies are showing the challenges of moving to a post-Covid normality. Israel, which led on vaccinations, is now experiencing a spike in cases – and starting booster shots. And New Zealand has entered nation-wide lockdown after community spread of delta (and a low vaccination rate). The Reserve Bank postponed what would have been its first policy rate increase since the crisis.

But it is not all bad news. Singapore is proceeding with the re-opening of borders. And economic activity across many small European economies has bounced back quickly as restrictions are lifted, even in the presence of delta. The Netherlands is a good example.

Several small economies are using the hard stop of international tourism in the Covid period to rethink approaches to international tourism. In European cities like Amsterdam and Prague, there is a rotation of focus to higher value tourism away from mass flows. And Iceland has used the Covid shock to diversify its economy away from a heavy reliance on tourism.

Tensions are growing between Lithuania and China, with Lithuania withdrawing from the 17+1 grouping of CEE economies and China - and strengthening its relationship with Taiwan. It is now on the receiving end of Chinese displeasure: China’s Ambassador has been withdrawn, trade has been halted, and it is no longer on the route for rail traffic from China to Europe. China’s Global Times is not amused.

US VP Kamala Harris was in Singapore this week, with positive noises about US engagement in the region – and suggesting that the US was not in the business of making countries choose between the US and China.

There is more political uncertainty in Sweden, with the Prime Minister announcing his resignation from November. The current Finance Minister is the most likely successor.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling