Fiscal & geopolitical change will drive shifts in the ability of the US to attract allocations of capital from the rest of the world

Read MoreGlobal economic and geopolitical regime change continues to accelerate

Read MoreDespite market calm, economic risks and political stresses are building - along with structural economic and geopolitical change

Read MoreEvidence of global economic and geopolitical fragmentation continues to accumulate

Read MoreAlongside high profile trade wars, expect structural change to cross-border capital flows - which will be at least as disruptive to the global economy

Read MoreSmall advanced economies provide useful perspectives on responding to a disruptively changing global economic and geopolitical context

Read MoreThe world at the end of March is a very different place than in January; and this is only the start of disruptive change in the global economic & geopolitical system.

Read MoreThree years on from the second Russian invasion of Ukraine, a new global economic and geopolitical order is emerging

Read MoreBeyond the economic & political disruption in the US, ten recent developments provide insights on emerging global dynamics.

Read MoreThere is high potential for economic and geo/political disruption in 2025. Ten developments in December provide a sense of what to expect.

Read MorePublic debt continues to rise across advanced economies, creating economic and geopolitical risk exposures

Read MoreA slowing US economy is attracting significant attention; but China poses a more significant risk to the global economy

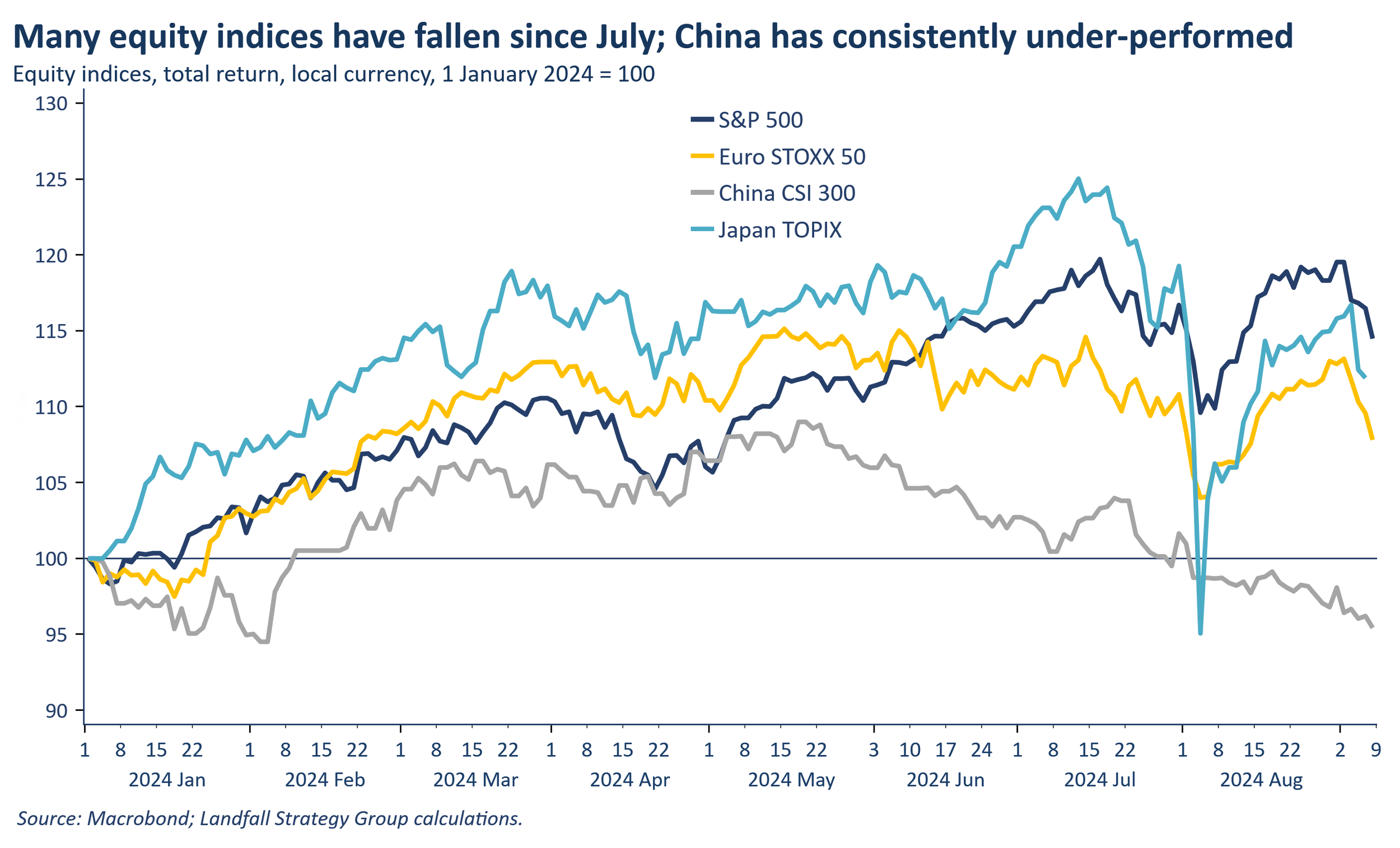

Read MoreThe (northern) summer has been dominated by political and economic turbulence; expect more to come

Read MoreStructural changes in politics and policy are underway across advanced economies – with material economic consequences

Read MoreThe ability to finance the great reindustrialisation will be a key driver of national economic performance: only some economies are positioned to benefit

Read MoreRecent market volatility after elections illustrates the economic importance of political institutions; with implications for the US Presidential election

Read MoreTrade flows capture changes in the geopolitical context: global economic fragmentation continues to sharpen, driven by geopolitical rivalry

Read MoreInvestment is strengthening across advanced economies for economic & geopolitical reasons, with effects from commodity prices to macro policy & productivity growth

Read MoreThe strong USD is generating economic pressures around the world, with the potential for disruptive responses – reinforced by geopolitical rivalry

Read MoreA roaring '20s will require a much stronger economic recovery from Covid than from the global financial crisis. What are the chances?

Read More