Winners & losers in a changing global economy

In the land of the blind, the one-eyed man is king’, Erasmus

I’ve been continuing my post-Covid travels to small economies. I’ve been in Dubai (again) and Switzerland over the past week (I am writing this note from a high speed train back from Basel to Amsterdam). And I was in Ireland a few weeks ago and Singapore a couple of months back.

These small economies are all significant nodes in the global economy, and are valuable bellwethers for the health and functioning of the global economy.

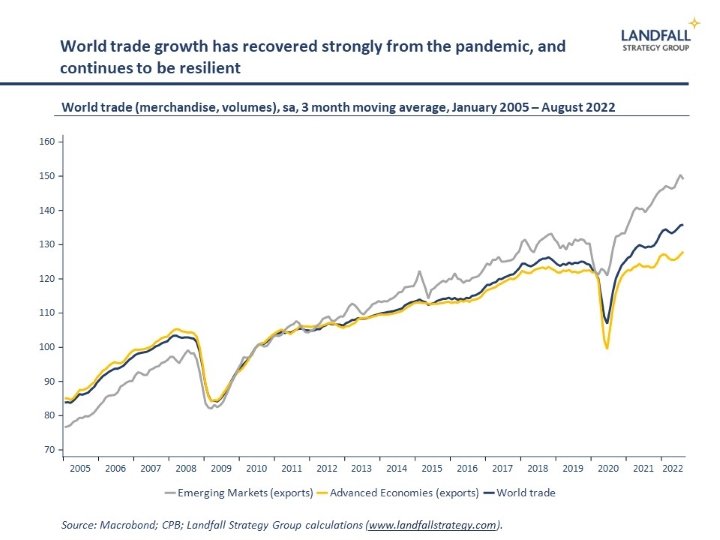

Regular readers will know that I remain relatively positive on globalisation; it is changing in shape more than unwinding. There are many frictions and costs, but merchandise trade is as likely to be diverted as destroyed. And growth in services, notably digital trade, continues to be strong. This is reflected in the relatively strong economic performance of many small economies, from Singapore to Ireland.

Of course, the global outlook is not so positive. The latest IMF World Economic Outlook, discussed in my last note, forecast weakening world GDP growth into next year - and for growth in world trade volumes to falter to ~2.5% in 2023, slowing from the fast pace of the post-Covid recovery. The WTO’s latest forecasts suggest even weaker growth (1%) in world merchandise trade volumes in 2023.

Alongside this is the increasing weaponisation of international commerce, with decoupling picking up between the West and China. The US announced sweeping restrictions on semiconductors in the past week; and President Xi’s speech at the recent Party meetings made it clear that security and political considerations trump economic objectives.

Across many large economies, there is a shift to a ‘war-time footing’ – the return of industrial policy, some protectionism, a focus on strategic autonomy, and so on.

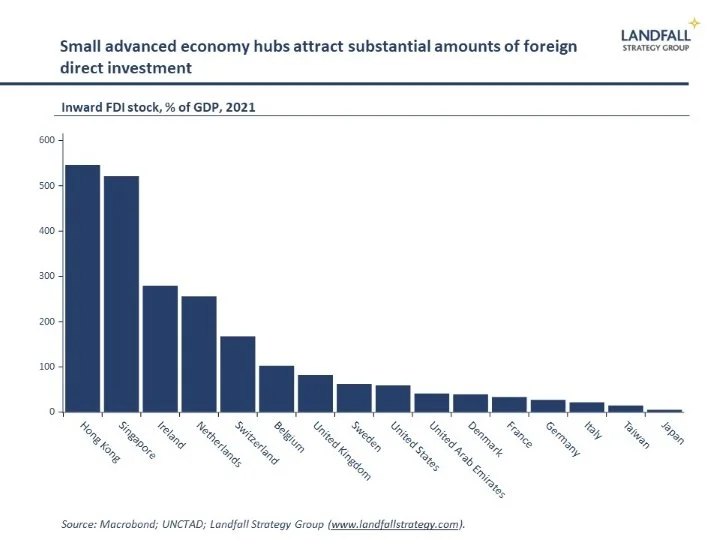

This is challenging for small advanced economies, with economic models that are based on high levels of international engagement – and even more so in small economy hubs like Dubai, Singapore, and Ireland. Most small economies have high correlations with world trade and GDP growth. When the world coughs, small economies are exposed to catching a cold.

Small economy global hubs

But my recent observations of small economy global hubs suggest an encouragingly resilient story.

Dubai and Singapore are key global hubs for flows of trade, capital, and people, benefiting from the intense globalisation over the past several decades. There are important differences between their respective economic models, but both are heavily leveraged to the strength of global flows - and might be expected to be particularly exposed to growing economic and political constraints on globalisation.

Singapore and Dubai are experiencing strong FDI and portfolio capital inflows, with firms and investors choosing to locate in these hubs. For example, Singapore attracted S$14 billion of investment in the year to Q2 2022 (~2.5% of GDP). And small economy hubs are receiving strong inflows of people, encouraged by government policy: they are deliberately competing for the mobile talent and economic activity that is on the move in response to changing global economic and political circumstances.

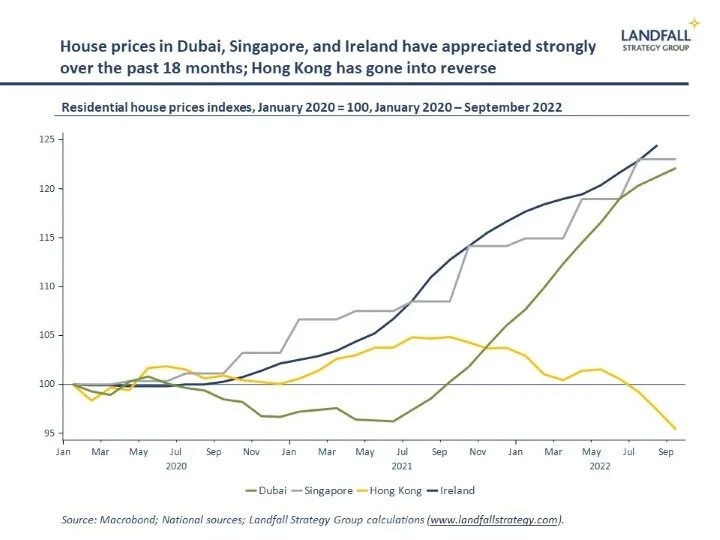

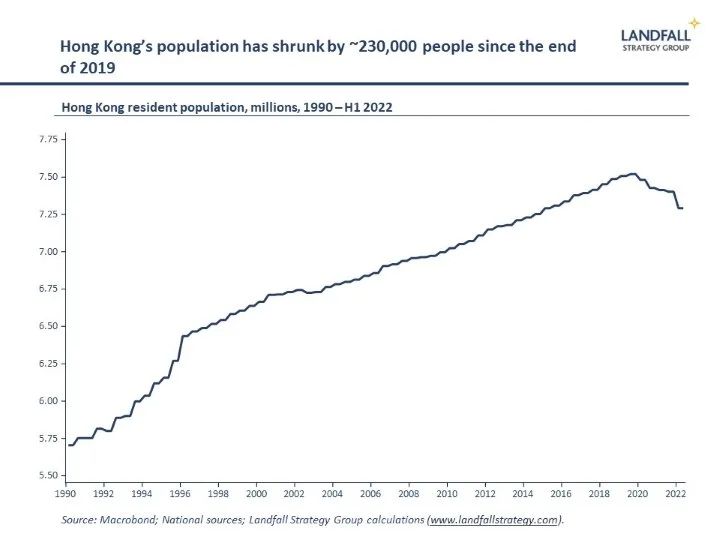

Singapore is benefiting from outflows of firms and people from Hong Kong, motivated by ongoing Covid restrictions as well as the increasingly intrusive policies of Beijing. The de facto ending of the ‘one country, two systems’ approach has made Hong Kong less attractive to many; Hong Kong’s population has shrunk by ~230,000 people since the end of 2019. And this seems likely to continue despite the government’s recently announced initiatives to attract people to Hong Kong.

Dubai positioned itself as open through the pandemic, with very high vaccination rates and light-touch lockdown restrictions. It was able to sustain relatively strong tourism and migration inflows. And these measures have accelerated in the post-Covid world: aggressive efforts (tax, residency) to attract people, capital, and firms – supplemented by inflows of Russian people and money.

Similar dynamics can also be seen in Ireland. Ireland has been one of the best-performing advanced economies through the pandemic, with strong GDP growth. Despite concerns about corporate tax increases, Ireland’s value proposition remains strong. And it is benefiting meaningfully from Brexit diversion flows, as people and firms choose to locate in an EU member state.

Ireland continues to receive strong inflows of FDI, as well as substantial inflows of people. Gross migration inflows are running at ~2.4% of resident population over the past year: passport applications and residency applications have surged.

These substantial migration inflows across many small economy hubs have contributed to strong real estate price appreciation and house price rental growth – despite increasing interest rates. This appreciation is even more pronounced at the top end of the market (for example, sale prices of villas in Dubai are up by >35% since January 2021). This may not be sustainable (or desirable) but it provides an indication of the magnitude of these flows.

These dynamics also play out in other small economy hubs. In Switzerland, healthy amounts of inward investment continue to arrive. Switzerland benefits from its political stability and positioning as well as leading innovation and business environment. This investment is despite the relatively strong currency. The CHF continues to provide a safe haven, performing relatively well against the USD (down 10% this year, compared to 16% for the euro, and 21% for the GBP).

The Netherlands is benefiting from hundreds of firms and financial institutions relocating from post-Brexit UK (and elsewhere). Both Swiss and Dutch equities have been hammered this year (down by about a third since January), because these markets are dominated by large, externally-focused firms. But as a location of choice, Switzerland and the Netherlands continue to perform.

Safe havens from stormy seas

Although small advanced economies are often thought to be exposed to stormy global economic weather – lacking the ballast and diversification of larger economies – it turns out that some small economies provide safe havens.

There are many examples of smaller economies benefiting from the mistakes and poor decisions of larger economies – from the behaviour and decisions in the UK over the past several years since Brexit to China’s de facto termination of the ‘one country, two systems’ approach in Hong Kong. People and firms are voting with their feet in response.

Small economies benefit from a displacement or diversion effect when large countries look like weaker bets. Small economies that position themselves by developing a strong position of competitive advantage can continue to do well. Indeed, small advanced economy hubs are currently capturing global market share from larger competitors.

Of course, small advanced economies are deeply exposed to a slowing, volatile global economy. And merchandise trade growth out of these small economy hubs is beginning to slow as large parts of the global economy also slow.

But this experience shows that small economies have a measure of agency: global trends are not deterministic. Small economies – and others – can prosper by strengthening their competitive position even in a challenging global environment.

The starkly varying trajectories of the previously similar-ish city states of Singapore and Hong Kong show how much policy choices matter: Hong Kong’s population is shrinking, its GDP growth was negative in the year to Q2, and investment inflows are muted.

There are winners and losers from the regime change underway in the global economy: those that have something distinctive to offer can do well. But it is a more demanding environment for those that are not distinctive in a more challenging global economic and political environment. Both large and small economies need to deliberately position themselves for this changing global context.

If you are not subscribed yet and would like to receive these small world notes directly by email, you can subscribe here:

We provide insights and advisory services to firms, investors, and governments on responding to global economic and geopolitical dynamics. Please do get in touch with me at contact@landfallstrategy.com if you would like to discuss how we can support you.

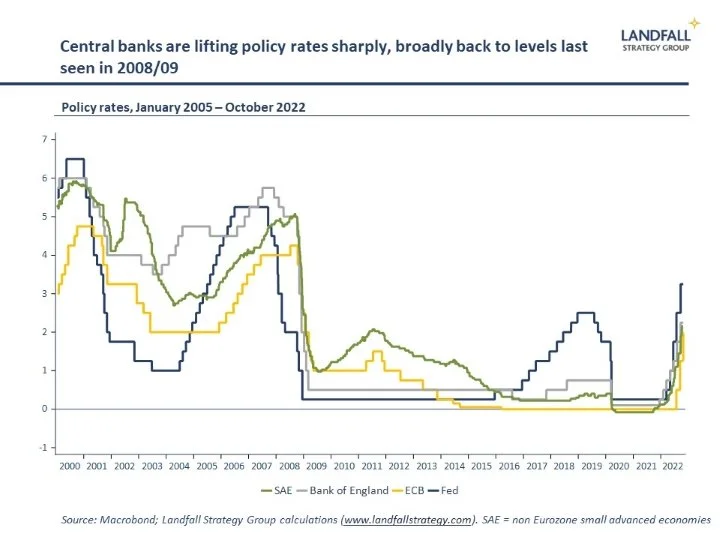

Chart of the week

The ECB announced a 75bp increase in the policy rate yesterday, for a total of 200bp of increases since January. Across most advanced economies (ex Japan), policy rates are back to levels last seen in 2008/9 as rates were being cut to respond to the global financial crisis. Economies with relatively high core inflation (the US, the UK, Australia, New Zealand) are generally moving more aggressively. This rapid increase in rates is weighing on economic activity.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

https://davidskilling.substack.com