Believe (much of) the hype

You can subscribe to receive these notes by email here

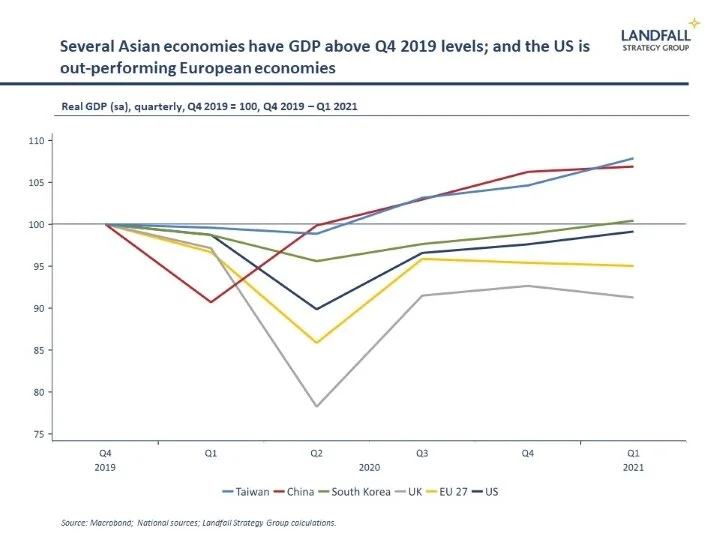

The global economic recovery is continuing, although with variation around the world. For example, several Asian economies, from Taiwan and South Korea to China, already have GDP back above Q4 2019 levels - well ahead of most Western economies.

And there is an emerging gap between the US and Europe. The EU27 went back into recession in Q1, while the US is registering strong GDP growth. This is due to factors in the US such as the speed of the initial vaccination programme, the extent of macro policy stimulus, and the loosening of lockdown measures.

However, Europe will likely close the gap through 2021 as its vaccination programme speeds up and economies reopen over the summer. The European Commission’s latest economic forecasts, released on Wednesday, sharply marked up its forecast 2021 GDP growth for the EU27 from 3.7% to 4.2% - on the back of accelerating vaccinations and EU-wide fiscal stimulus. By 2022, EU27 GDP growth is forecast to exceed the US.

The small economy recovery process

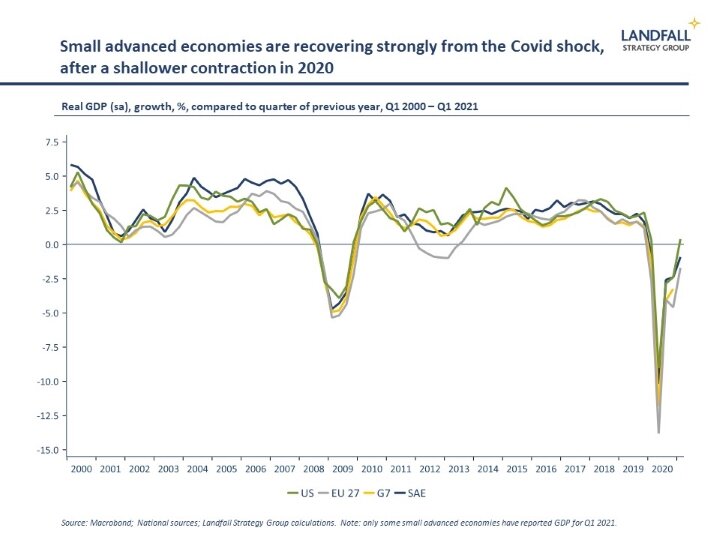

Another interesting dynamic is the extent to which small advanced economies are out-pacing their larger counterparts. Small economies had a shallower contraction than large economies through 2020: across my group of 12 small advanced economies, GDP was down 3.3% in 2020 compared to a ~5% contraction for the G7.

And the IMF forecast faster GDP growth in small economies than in large economies over the next several years, as I discussed recently.

Q1 GDP numbers are looking generally good for the small economies that have reported. In Asia, Singapore registered a third consecutive quarter of GDP growth (+2.0% qoq in Q1); and in Europe, small economies like Sweden, Austria, and Belgium grew in Q1.

The reasons for this strong small economy performance include high quality Covid management, large and well-directed fiscal stimulus, and resilient world trade growth. The small economy model continues to perform.

Through 2021, the extent of domestic fiscal stimulus will become a less meaningful source of growth. Instead, the strength of global demand – transmitted through demand for small economy exports, as well as investment income flows – will become more important.

Indeed, small economy export growth (excluding international tourism) has been a source of economic support over the past year. Small economy exports continue to grow strongly in 2021, after a resilient performance in 2020.

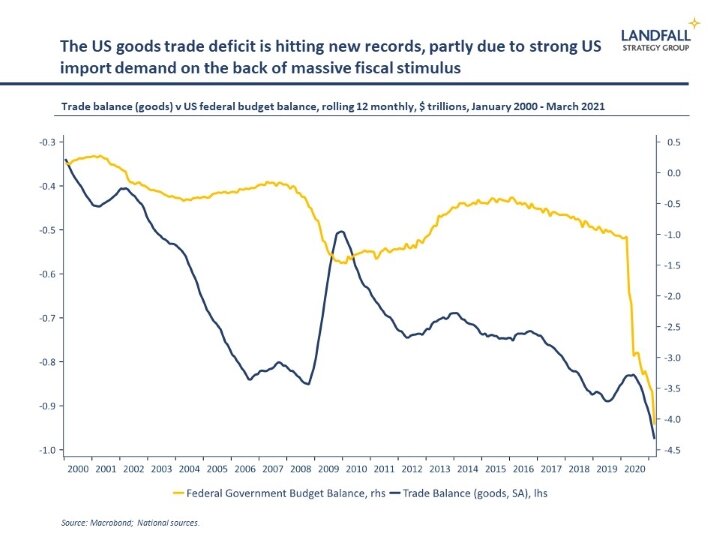

The massive US fiscal stimulus will provide meaningful support to small economies as US firms and consumers buy more foreign goods. Note that the US trade deficit reached another record in March, at close to $1 trillion for the year.

Canaries in the mine

This recent experience is consistent with small economy performance through previous economic shocks. During the global financial crisis, small economies experienced a shallower contraction than the G7 followed by a more rapid recovery process. In Singapore for example, GDP growth was down by 8% in the year to Q1 2009 before 18% growth in the year to Q2 2010.

Small advanced economies are a high beta play on the global economy, with a high level of sensitivity to the strength of the global economy. Small economy growth accelerates in periods of strong global economic activity (and vice versa) to a much greater extent than in large economies. There is a tight relationship between labour productivity growth and world trade growth across small advanced economies.

This sensitivity to the global economy is due to their high external shares (exports/GDP, international investment income flows from direct investment). In a sense, small economies are like emerging markets, but with stronger institutions, innovation capability, and so on.

There is variation across small economies. Those with lower external shares, or that export more defensive goods (such as commodities), tend to be less sensitive to the global economy.

But overall, small economies are primary beneficiaries of a strong global economic recovery. This exposure to a strong global economic recovery is also reflected in equity market performance. Small economy markets like Denmark, Finland, Sweden, and the Netherlands, have out-performed regional benchmarks over the Covid period.

This sensitivity means that small economies can function as canaries in the mine of the global economy, providing a good gauge of the strength of the global economy. From GDP growth to strong export data, and record PMI levels in economies like Switzerland, Austria, Sweden, the Netherlands, and New Zealand, the small economy experience provides confirming evidence of a robust global recovery process.

Looking ahead

Although there will be economic and political turbulence along the way, and controlling Covid is a marathon not a sprint, the small economy perspective on the global economy is a positive one. Concerns about inflation and market volatility over the past week should not detract from this underlying story.

Governments, firms, and investors should act accordingly, investing ahead of the curve to capture the benefits of the global economic recovery. Indeed, I have argued that there is a likelihood of a productivity renaissance over the next decade, supported by the accelerated adoption of technology and new business models.

Although there is much uncertainty about these productivity dynamics, small advanced economies – deeply exposed to global competition – will be a good place to look for early evidence of a meaningful lift in productivity growth over the next few years.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors. Do let me know if your organisation is interested in arranging a discussion.

Chart of the week

Passenger traffic through small economy airport hubs shows that international aviation remains depressed. Movements through Singapore and Hong Kong are currently below 3% of pre-Covid levels. Schiphol in the Netherlands is at around 13%, broadly in line with the large European airports like Heathrow and Frankfurt. Dubai’s December 2020 passenger movements were down by (a better) ~70% from the previous December, as its borders remained largely open. International passenger flows will pick up over the Northern summer months, but it remains a long way from normal.

Around the world in small economies

The SNP won a strong victory, but came just short of an outright majority, in last week’s Scottish Parliamentary elections, winning 64 out of 130 seats. There is a majority in favour of a second independence referendum; the SNP plus the Greens have a majority in the Parliament. But the UK Government is opposed to a second referendum, and the path forward will likely be a bumpy one.

In another reminder that managing Covid-19 is a marathon not a sprint, Singapore and Taiwan have both imposed new restrictions in response to new cases in the community. Taiwan has limited the size of events, and Singapore has placed limitations on social gatherings and tightened border restrictions.

The European Commission released its Spring economic forecasts on Wednesday, sharply upgrading its previous forecasts from February on the back of vaccines and the roll out of the EU Recovery & Resilience package. European small advanced economies are forecast to grow strongly through 2021 and 2022, even after a relatively shallow contraction in 2020, out-performing GDP growth in the EU27 and Eurozone. and Eurozone.

Denmark has had negative policy rates since 2012, which has led to negative mortgage rates being available. But increasingly Danish savers are also exposed to negative rates, which has made this issue more politically sensitive. Dutch banks are also reducing the threshold above which savers will have to pay negative rates on their retail deposits.

Greece has submitted its proposal to the European Commission for funding under the EU Recovery & Resilience package. It is well regarded for its quality; and Greece will be one of the largest recipients. Greece suffered a significant GDP contraction in 2020, as international tourism cratered. But the Greek government is already moving to implement several of the reform initiatives. The growth forecasts are strong, and investors are becoming more interested in Greece.

Norway has raised its planned fiscal deficit to around $50 billion, which will be funded by a greater than expected withdrawal out of its $1.3 trillion sovereign wealth fund. Elsewhere in small economy sovereign investing, the Swiss National Bank’s holdings of US equities increased to $150 billion at the end of March.

The process to form a government in Israel after four inconclusive elections in two years continues. Current Prime Minister Netanyahu has failed to assemble a coalition, and the President has given a mandate to Yair Lapid, the centrist opposition leader, to try to form a government within 28 days. If unsuccessful, a fifth election looms this summer.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling