Covid & the winner's curse

You can subscribe to receive these notes by email here

The impact of differences in national political choices and risk tolerances is becoming increasingly evident as successful vaccination programmes across advanced economies provide the basis for reopening economies and societies.

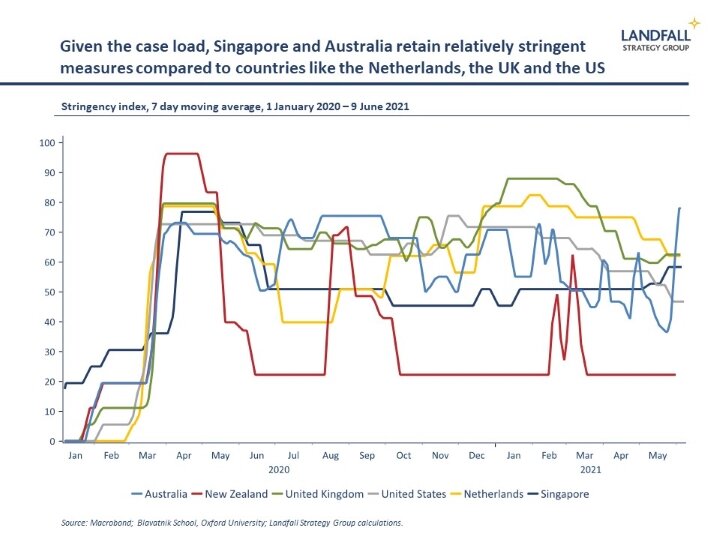

By any measure, the Dutch Covid experience has been worse than in Singapore: total reported Covid deaths of >1000 per million against <6 per million in Singapore, with Dutch excess deaths higher again. And this past week, daily cases in the Netherlands averaged ~115 per million compared to Singapore’s 3 per million. Singapore is also further advanced in vaccinations.

But a few weeks ago, as Rotterdam hosted Eurovision in front of a scaled-down crowd, Singapore cancelled the World Economic Forum and Shangri La conferences. And just this week, as the Dutch drank Heineken in reopened beachside bars, September’s Formula One race in Singapore was cancelled.

This partly reflects different national risk tolerances. As Singapore’s PM Lee recently noted, Singapore (and others) will need to adapt over time to operating in a ‘new normal’ in which Covid remains endemic even as vaccinations become widespread.

A key challenge facing advanced economies is the transition to economic normalisation – opening up domestic economies and national borders – in the presence of ongoing Covid risk. This will require changes in the risk tolerance of successful countries over time as vaccinations reach much of their populations.

Past performance is no guarantee of future success

The varying success of different countries in managing through Covid has been a common theme in these notes. There is a pronounced winner’s curse dynamic: countries that performed well in the management of Covid have often done poorly in vaccinations – and vice versa.

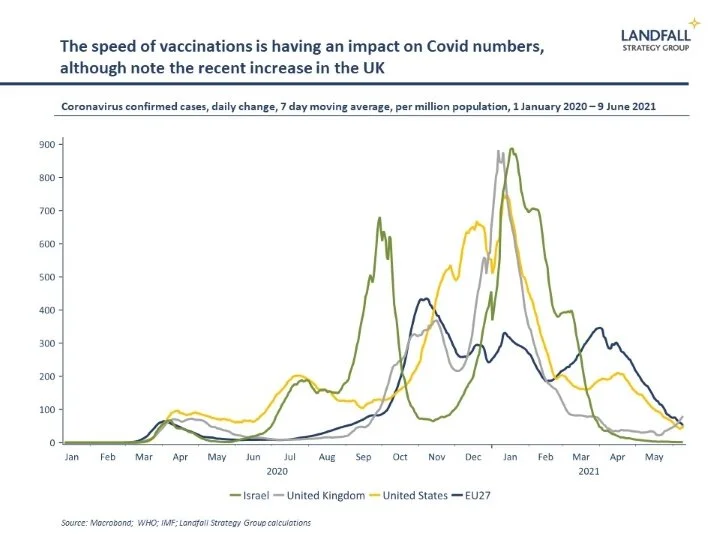

The US, the UK and Israel are opening up quickly compared to Taiwan, Hong Kong, and Japan because of the impact of aggressive vaccination programmes – despite a much inferior record in overall cases and deaths.

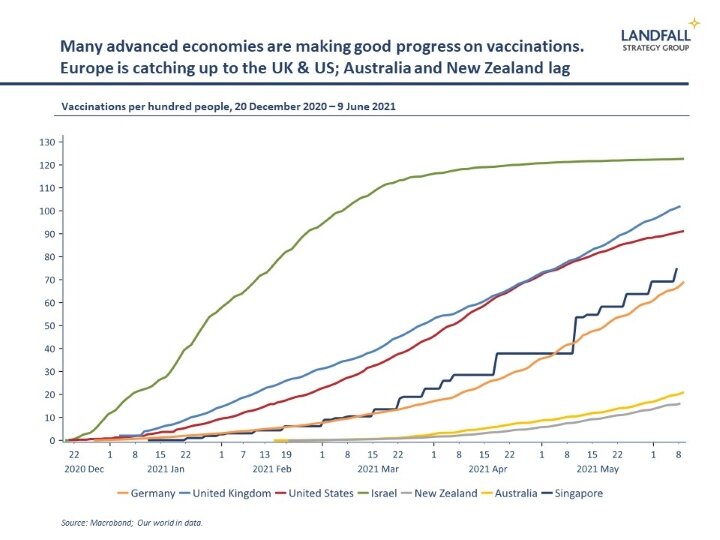

Variation in vaccination performance is partly due to different structural characteristics across countries – as well as the relative sense of urgency because of prior performance in managing the spread of Covid.

The transition to opening up will likely also be characterised by the winner’s curse. Countries that have chosen zero/very low risk approaches will have a longer transition to reopening. For example, Australia and New Zealand continue with their closed border policy, and targeted lockdowns in response to new cases, as part of an elimination strategy. This approach has generated strong health and economic outcomes.

But the transition to opening up borders – with the non-zero risk that this brings – will be difficult given the sustained policy focus and messaging on elimination as well as the strong public support for this approach.

Australia and New Zealand borders will be largely closed until 2022, when domestic populations are vaccinated, placing them at a disadvantage in reopening. Corner solutions to risk can constrain policy options, backing countries into a corner.

In contrast, the more liberal European approach to risk – which has had a markedly worse Covid experience than many developed Asian economies – combined with a steadily improving vaccination record, allows for a more rapid reopening.

The risk averse approaches that worked effectively in the early stages of Covid are unlikely to work as well as vaccinations become widespread and the global economy opens up. The management of the opening up process needs to be supported by tolerance for non-zero risks.

Of course, disciplined risk management remains important. New Covid variants will create challenges with opening up: the Delta variant is causing concern in the UK and elsewhere, perhaps requiring further restrictions. But the balance needs to be struck well: binary approaches to risk are generally not helpful on a sustained basis.

The argument that aggressive lockdown measures simultaneously delivered good economic and health outcomes was broadly true in the early stages of Covid. But it is less true now in the context of a vaccination-supported reopening. Some successful countries will need to recalibrate their risk tolerances as vaccination coverage extends.

Reopening in a changed world

The winner’s curse dynamic will also likely be seen in the nature of policy efforts to position economies for a very different post-Covid global economic environment. The shape and functioning of national economies has changed disruptively as a consequence of the Covid shock.

Governments and firms need to respond to structural changes to labour markets, economic growth models, the growth outlook across sectors, globalisation, and so on. And there is a macro policy regime change underway.

But the risk is that those countries that generated resilient economic outcomes through the Covid shock may not feel the same urgency to adapt as countries that experienced significant economic pain. These high-performing countries will need to muster the urgency to respond actively to a changing global economy.

In this regard, I am positive about the outlook for small advanced economies. Small economies often recover quickly from economic shocks because their acute exposure to competitive pressure – as well as high levels of state capability – supports agile, response decision-making. This ‘constructive paranoia’ about national competitive positioning can be a good thing.

It is too early to say which countries will turn in the strongest overall Covid performance. Different countries have been good at different things through Covid; and initial success often seems to foreshadow underwhelming performance.

For those countries that have been successful to date, priorities include adapting national approaches to risk tolerance as vaccinations allow for opening up, as well as acting with determination on a structural policy agenda. The extent of urgency over the next several months on these issues will be central to national success – and avoiding the winner’s curse.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors. Do let me know if your organisation is interested in arranging a discussion.

Chart of the week

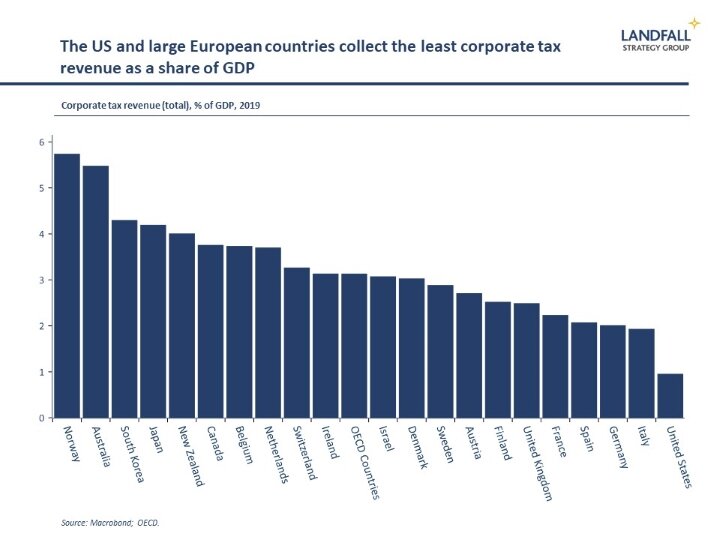

G7 Finance Ministers announced an in-principle agreement last weekend on global corporate tax, including a global minimum corporate tax rate of ‘at least 15%’. This is partly to protect them from international tax competition. It is striking that five of the G7 members (ex Japan and Canada) collect little corporate tax revenue compared to smaller advanced economies; Ireland is around the OECD average. There is clearly need for sweeping corporate tax reform to prevent aggressive tax planning. But supporting the OECD’s successful BEPS process and fixing domestic tax systems is likely better than constraining policy competition.

Other writing

The New Zealand government has recently legislated that all government agencies prepare long-term insights briefings that will cover key emerging issues. I contributed to an op-ed on how to think about this exercise, and what can be learned from some of the international experience. It is available here.

Around the world in small economies

‘Do we need to be in Hong Kong?’ Hong Kong’s status as a gateway between the West and China is being challenged, with more accounts of exits of international firms and people in response to the tightening Chinese grip on Hong Kong. And last week, Hong Kong banned the annual Tiananmen Square vigil and arrested organisers.

Israel recorded zero new domestic Covid cases on Saturday for the first time in a year, reflecting its rapid national vaccination programme: about 60% of the population is fully vaccinated.

The Swedish Government has proposed changes to the mandate of the central bank, to include employment and consideration of climate change impacts. This has not gone down well with the Riksbank’s leadership.

The Irish Government published its Economic Recovery Plan to guide Ireland’s post-Covid economic policy. This €3.6 billion package includes funding for training programmes, support for impacted sectors like tourism, as well as green and infrastructure initiatives.

A 12.5% stake in the commercial operations of New Zealand’s world-beating All Blacks is on the table. A sale to a US private equity firm has been approved by New Zealand Rugby, but is now facing significant blowback – with a partial sale to the New Zealand public also proposed by deal opponents.

Over a decade on from the Greece’s near death experience after the global financial crisis, Greek sovereign debt is seeing strong demand.

Small economies are moving on climate change. New Zealand’s independent Climate Change Commission has just released its report with advice to the government on how its legislated net zero target can be achieved. And Singapore’s central bank issued its inaugural sustainability report, including a range of green initiatives - from developing green finance in Singapore to incorporating climate change into its investment framework.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling