A week where a decade happened

You can subscribe to receive these notes by email here

‘There are decades where nothing happens; and there are weeks where decades happen’, Vladimir Lenin

With apologies for quoting a Soviet dictator, it feels like something has snapped this week. Amid the barbaric violence of the Russian regime, and remarkable Ukrainian courage and resistance, international economic and political transformations are underway that will reshape the world.

My note last week suggested we have reached ‘the end of the beginning’ in transitioning to a new global regime, with the Russian invasion crystallising the scale of the challenge to the global system. But events have moved much more quickly over the past week than I anticipated.

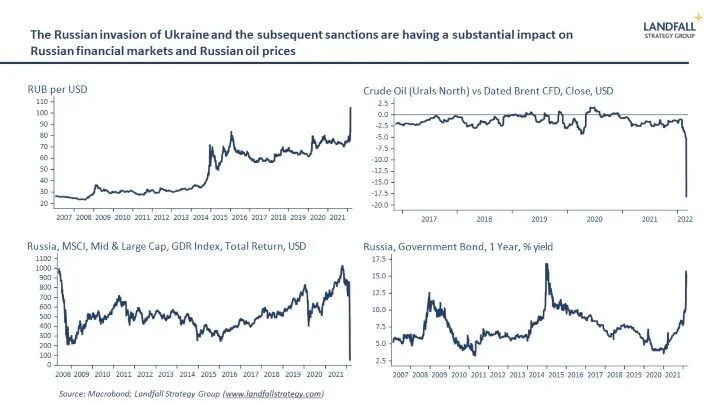

Russia has not so much been sanctioned as ejected from the mainstream of the global financial system: multiple Russian banks are being disconnected from SWIFT, and cannot engage with Western institutions; access of the Russian central bank to its reserves has been frozen; Western firms have withdrawn Russian access to payments systems; and oligarch assets are being seized.

Even Russia’s role in the global energy system is challenged, with sanctions reducing the willingness of counterparties to buy oil from Russia; the price difference between Russian oil and the Brent crude benchmark has blown out.

Russia is no longer investable. Institutional investors around the world are divesting Russian asset holdings where markets exist. The rouble is down ~30% on the week despite higher interest rates; and Russian equities traded globally have lost most of their value. Inflation will spike higher, supply chains in and out of Russia are deeply disrupted, and Russian planes are increasingly grounded.

There is a growing likelihood that the gears of the Russian economy will freeze up in the next weeks, particularly if gas exports to Europe are constrained. China may provide some support to stave off the worst outcomes, but Russia’s economy – the 11th largest in the world in USD terms in 2021 – is in deep trouble.

Choices to make

Beyond the direct economic impact, Russia’s invasion of Ukraine and the international response marks a structural break in the global system. It is accelerating the emergence of competing blocs in the global system.

This week’s votes condemning the Russian invasion in the UN Security Council (vetoed by Russia, with China, India, and the UAE abstaining) and the UN General Assembly (141 in favour, 35 abstentions, and 5 opposed) provide a sense of the contours of this emerging world.

Singapore is a useful canary in the mine of the global system: deeply exposed to external developments, very thoughtful, and geographically between the West and East. For this reason, Singapore’s powerful statement to the UN General Assembly was telling: it noted that Russia’s invasion of Ukraine was a ‘a clear and gross violation of international norms’ and an ‘existential issue’ for small states that are endangered by a world order based on ‘might is right’.

There is a broad group of countries that are supporting the rules-based order. The EU has moved with urgency and purpose, waking up from a period of complacency. The EU and EU members are imposing sanctions, supplying military equipment, and providing financial support, visas and migration support, and so on. We can expect a more forward-leaning European approach on strategic matters, and that invests more in security. As always, the EU advances one crisis at a time.

One of the most remarkable developments was last Sunday’s statement by the German Chancellor, committing to massive increases in defence spending, providing direct military support to Ukraine, and rebuking Russia, essentially reversing the past few decades of German foreign policy. Elsewhere, Swiss neutrality has been put on hold to align with EU sanctions on Russia, there are now public majorities in favour of NATO membership in Sweden and Finland, and Turkey has closed the Bosphorus to naval vessels.

And there was broad bipartisan support for the parts of this week’s State of the Union speech by President Biden focused on Ukraine.

But different calculations are being made by others. China is treading carefully, with a position of ‘pro-Russian neutrality’. There are perhaps some upsides for China from the current situation, but my sense is that Russia’s invasion is largely negative for China. I expect these events to accelerate the process of Western decoupling from China, reinforced by Chinese moves to reduce economic and financial exposures to the West (having watched what the West has done to Russia this week).

Elsewhere in Asia, it is a mixed picture. Australia, Japan, South Korea, Taiwan, and Singapore are taking action in sanctioning Russia; New Zealand is being unfortunately timid – saying the right things, but not acting aggressively. India and Pakistan are hedging, due to longstanding economic and security relations with Russia. Many of the ASEANs have been quiet (ex Singapore), despite their concerns about territorial integrity (e.g. in the South China Sea).

Although not a binary split, this variation in responses gives a sense of where the political fault lines are in the global system. Over time, global flows are likely to be shaped by these global political divides. Trade, investment, and technology flows are likely to follow political as well as economic imperatives, leading to decoupling. Globalisation will be much more political, regional, and fragmented.

Firms need to take (geo)politics seriously

The deeply integrated nature of the global economy means that firms need to make choices as well. They can no longer stand apart from international political developments. Indeed, this week, many firms have had to respond to formal sanctions or government pressure: for example, companies such as Shell, BP, and Equinor, have announced substantial divestments/write-offs of their Russian assets.

And many firms are suspending operations in Russian market, from Ikea to Maersk, Apple and Siemens. In some cases, this is because of difficulties in maintaining operations given the financial sanctions and other disruptions. But it is also due to concerns about continuing to do business in Russia from employees, customers, and investors: McKinsey, for example, has now committed to cease all client service in Russia.

And even FIFA and the IOC have now banned Russian teams from international competition because of pressure from sponsors, the public, and governments.

These realities extend beyond Russia. Western firms operating in China will find it increasingly difficult to satisfy governments and other stakeholders in both China and their home market. Choices will need to be made, as navigating competing stakeholder demands becomes increasingly difficult.

The ‘nationality’ of firms will become an increasingly salient feature in assessing political risk exposures. Major investments are less likely to be made into markets where geopolitical tensions are possible, with a preference for ‘values-aligned’ markets.

These private sector choices will make the sanctions on Russia more permanent. Even if governments were to lift sanctions, it is not clear that firms would readily return (at least not until their other stakeholders were satisfied). It is likely that Russia will not be served as it was before the invasion for many years.

Into a new world

Beyond the short-term responses, regime change is underway in the global system. My sense is that we will be able to date characteristics of the global economic and political system as ‘before’ and ‘after’ the Russian invasion of Ukraine; they will be quite different things.

These implications extend well beyond geopolitics and security. These dynamics will fundamentally shape global trade and investment flows as the global economy continues to fragment into different blocs. Governments, firms, and investors need to adapt to a new world that is emerging in real time.

If you are not subscribed yet and would like to receive these small world notes directly in your inbox, you can subscribe by clicking on the button below:

I undertake engagements and deliver presentations on global economic, policy, and political dynamics, and their implications, to policymakers, firms, and investors. Get in touch if you would like to discuss these opportunities.

Chart of the week

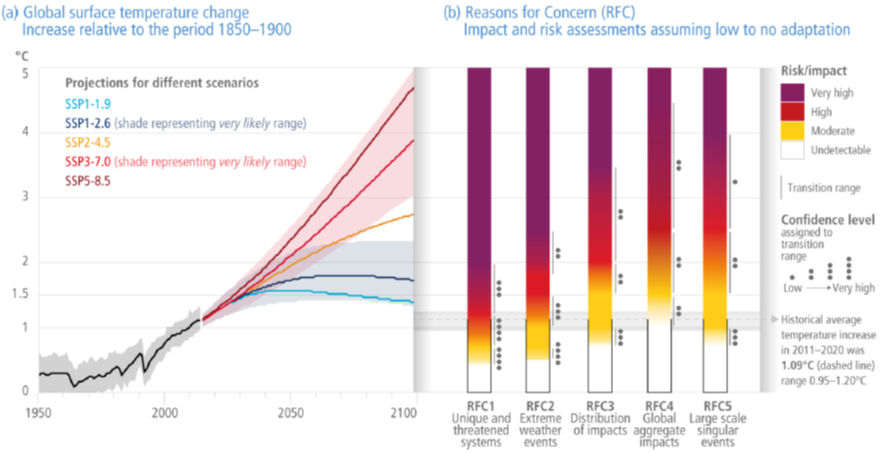

Beyond the security and economic challenges, this week has also reminded that the world is facing multiple, intersecting crises. Overshadowed by coverage of the tragic events in Ukraine, the IPCC released an updated report for policy-makers this week. The final paragraph noted: ‘The cumulative scientific evidence is unequivocal: Climate change is a threat to human well-being and planetary health. Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a brief and rapidly closing window of opportunity to secure a liveable and sustainable future for all. (very high confidence)’

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling