Inflation is not working

You can subscribe to receive these notes by email here

‘If the only tool you have is a hammer, it is tempting to treat everything as if it were a nail’, Abraham Maslow

The US reported 9.1% inflation this week, the highest since 1981, with the Fed now scrambling to respond: markets are pricing a rate hike of 75bp or more later this month. Surging inflation, and tightening monetary policy, is common across advanced economies and beyond.

This is partly an excess demand story, due to the strong economic recovery from Covid – supported by aggressive monetary and fiscal policy stimulus. And rising energy and food costs have made a substantial recent contribution.

More broadly, Covid has had an enormously disruptive effect on the functioning of advanced economies: global supply chain frictions, changed business models, dislocations in labour markets, and so on. Combined with the strong recovery, these supply side constraints have generated inflationary pressure.

Indeed, inflation is importantly about structural dynamics. Factors such as globalisation, demographics, and technology have placed significant downward pressure on inflation over the past few decades. The Great Moderation has not just been due to central bank actions. And monetary policy alone cannot deal with some of the structural drivers of inflation that are currently at work.

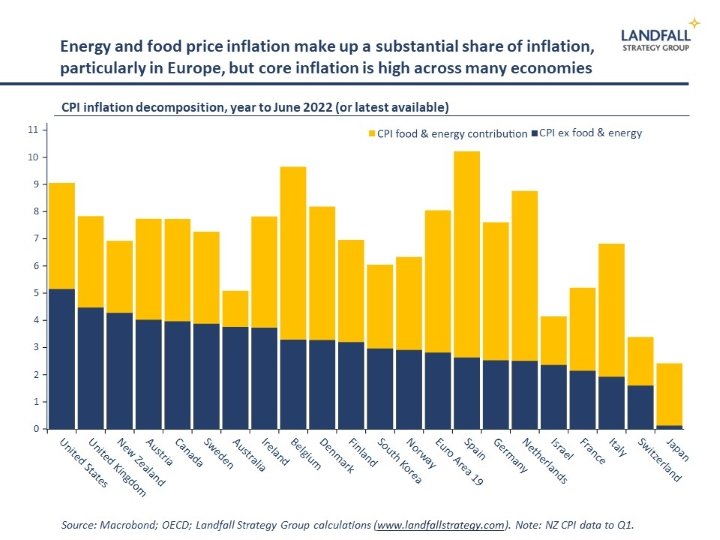

All advanced economies have inflation that is well above target levels. But there is variation in core inflation, excluding the contribution from food and energy prices. At the top are the US and the UK, as well as New Zealand. Many European economies have lower core inflation.

This is partly a function of the strength of the recovery and the extent of stimulus. But I’m struck that the economies that have high core inflation tend to have particularly acute labour market challenges.

Where have the workers gone?

Labour market performance across advanced economies through the pandemic has been strong, with unemployment rates not spiking up (ex the US) – largely because of aggressive policy measures. And unemployment rates are now sitting at relatively low levels, generally below immediately pre-Covid levels.

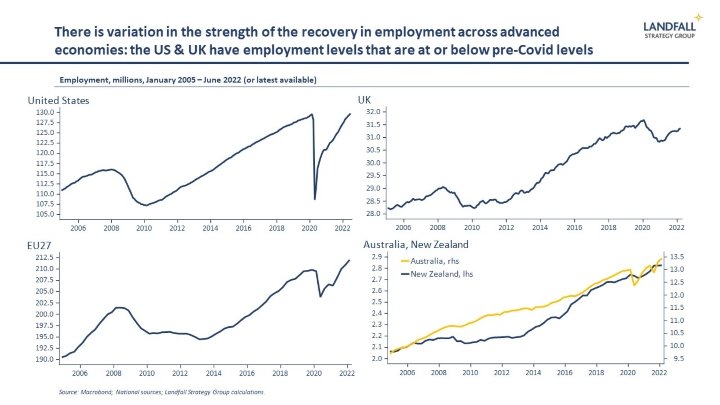

But there is meaningful variation across advanced economies in terms of underlying labour market tightness. For example, employment levels in Europe are well above pre-Covid levels, whereas the US has only just regained these levels – and the UK still has markedly lower levels of employment. This constrained labour supply reflects reduced labour force participation rates in the US and UK relative to Europe: the shares of the population in the US and UK labour markets have reduced through the pandemic.

The great resignation was real, at least in some economies, with people leaving the labour market: early retirement, sickness/childcare reasons, changed work/life preferences, and so on. Note also that policy approaches that kept people attached to the labour market through the pandemic have done better than the US, where layoffs were higher.

Another factor contributing to tight labour markets is reduced migration inflows. Australia and New Zealand, for example, have maintained high participation rates and low unemployment rates through the pandemic. But net migration inflows, which accounted for meaningful shares of working age population growth in these countries, went to zero during Covid. Because of this, labour supply growth in these economies is much weaker than pre-Covid rates, leading to labour shortages.

This is also the case in the UK, where Brexit has contributed to constrained employment growth and labour shortages. And in the US, the share of migrants in the labour force has reduced through Covid.

These labour shortages have created supply side constraints at the same time as demand is booming, constraining output and creating price pressures. Economies that have flexible labour markets with support for workers to stay in the labour market have done better in avoiding some of these supply side constraints.

Labour markets, disrupted

At a micro level, there has been substantial job churn through the pandemic. Workers have been voting with their feet, by quitting for jobs with better pay and conditions.

In addition, the location and nature of jobs has also changed through the pandemic: there are new areas of labour demand (from logistics to digital) and some sectors with reduced demand (physical retail). This will require an at-scale reallocation of labour across the economy as the supply and demand of labour is aligned across sectors.

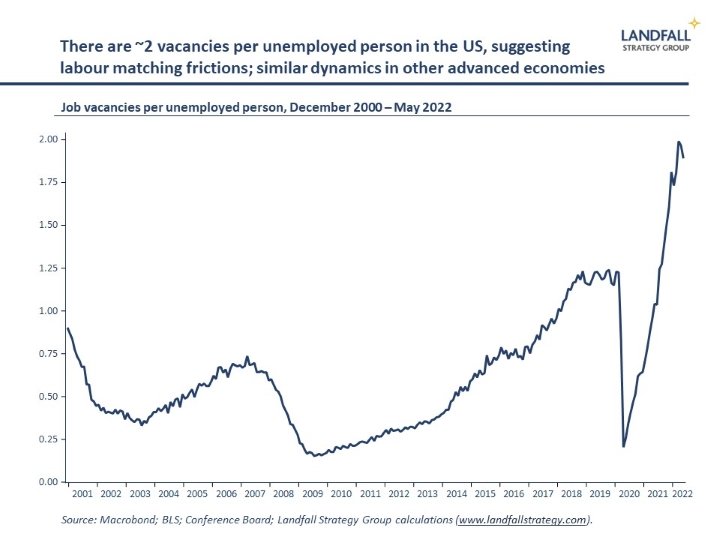

This process will inevitably involve costs and frictions as people and firms search for each other. One measure of the efficiency of the labour market search process is the ‘Beveridge curve’, which maps the number of vacancies against the unemployment rate. In many advanced economies, this curve has shifted out markedly (more job vacancies for every unemployed person), suggesting structural changes in labour markets. In the US, the ratio currently sits at ~2 vacancies for every unemployed person.

Economies that make strong investments in skills, have active and flexible labour market policy, and where firms are directly involved in the skills process (such as apprenticeships, vocational learning) should have an edge in this environment. Small advanced economies, many of which have these characteristics, are able to productively employ relatively large shares of their populations.

Demand v supply side policy

The scale of the economic shock of Covid inevitably meant that the recovery process would be bumpy. Labour markets are a key domain in which this is playing out, with implications for inflation.

Wage growth remains negative in real terms across advanced economies, with aggregate wage growth not keeping pace (yet) with inflation. But tight labour markets also affect product markets, creating shortages of products and disrupting supply chains – with consequent cost and price pressures. And the frictions between labour demand and supply also impose additional costs on firms.

Those economies that have been able to maintain labour supply growth, and help workers to efficiently move into new jobs, will have greater productive potential – weakening the inflationary pressures due to the mismatch between demand and supply. The Nordics, the Netherlands, and Switzerland are good examples.

Tighter monetary policy is needed to reduce excess demand. But pulling demand down to meet weaker supply can be self-defeating. Measures to push out the supply side of the economy are an important part of responding to inflation. And key to this will be ensuring that labour markets are working well: skills and training, flexibility, supporting conditions (childcare, minimum wages, etc).

Some economies, such as Singapore, are actively engaged in upgrading skills for the new demands of the post-Covid economy. But these supply-side policy efforts should be more widespread.

Looking forward

Favourable demographics, strong migration flows, the introduction of flexible labour markets, as well as import competition, have combined to support labour supply growth and dampen wage growth over the past few decades. The Philips curve famously disappeared.

But beyond immediate post-Covid stresses, structural changes in the global economy are leading to changes in this context.

Aging populations across advanced economies and beyond (notably China), as well as likely lower migration levels in some advanced economies, means that labour supply growth is likely to be structurally lower. This will create wage and price pressures that can’t easily be tamed by tighter monetary policy. Milton Friedman was not entirely correct.

‘Inflation is always and everywhere a monetary phenomenon’, Milton Friedman.

Governments will need to find supply-side measures to respond to these pressures, through labour market and skills policy, as well as encouraging the adoption of productivity-enhancing technologies such as automation. The demand-side hammer of monetary policy cannot be the only solution.

If you are not subscribed yet and would like to receive these small world notes directly by email, you can subscribe here:

We provide insights and advisory services to firms, investors, and governments on responding to global economic and geopolitical dynamics. Please do get in touch with me at contact@landfallstrategy.com if you would like to discuss how we can support you.

Chart of the week

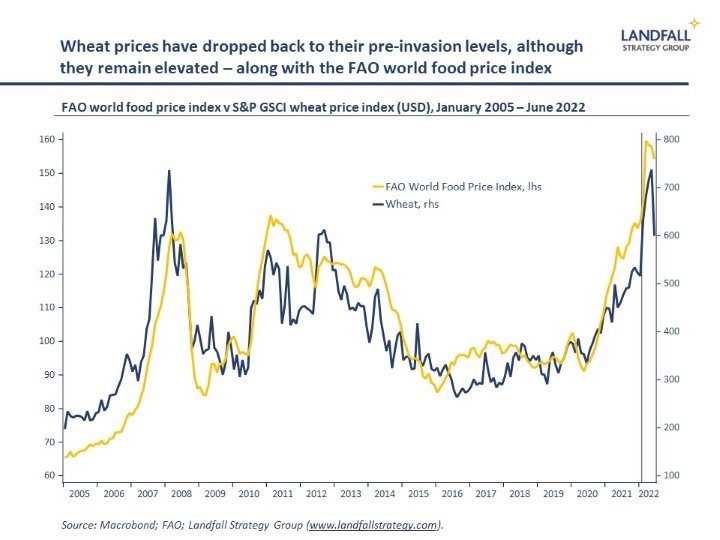

In good news, wheat prices have dropped sharply by ~25% back to around their pre-invasion levels. Increased global supply as well as increased wheat exports out of Ukraine have helped, as has reduced expected demand due to a slowing global economy. This should help to take some pressure off the highly elevated world food price index – which is just off record levels, up by >50% since 2019.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling